Table of Contents

✨ Introduction

Discover practical strategies for overcoming limiting beliefs about money and building a confident, abundant financial mindset. Let’s dive deeper…

Have you ever looked at your bank balance and felt a rush of fear… even when nothing was actually “wrong”? Or found yourself hesitating to invest in something important — not because you lacked money, but because you didn’t feel you deserved to spend it?

If yes, you’re not alone.

Across cultures, professions, and income levels, millions silently struggle with invisible mental barriers that hold them back from financial growth. Psychologists call these money scripts, subconscious stories that shape how you think, feel, and behave around money. They usually come from childhood, society, cultural conditioning, or past failures — and unless challenged, they become self-fulfilling limitations.

This article is a step-by-step transformation guide on overcoming limiting beliefs about money. Whether you’re a working professional, entrepreneur, student, or homemaker, your relationship with money influences your confidence, decisions, career growth, relationships, and overall wellbeing.

But here’s the empowering truth:

💡 Your beliefs about money are learned — which means they can be unlearned.

In my years of training individuals and teams across India, the Middle East, and Asia, I’ve coached thousands who carried self-defeating beliefs such as:

- “Money is hard to earn.”

- “I’ll never be wealthy like others.”

- “If I make too much money, people will judge me.”

- “I’m bad with money.”

- “Wanting money means I’m greedy.”

What amazed me is that once these internal stories were rewritten, financial breakthroughs followed — promotions, cleared debts, new businesses, better negotiation skills, and improved decision-making. Behavioural science supports this: According to research from the American Psychological Association, beliefs directly influence financial behaviour more than external economic factors.

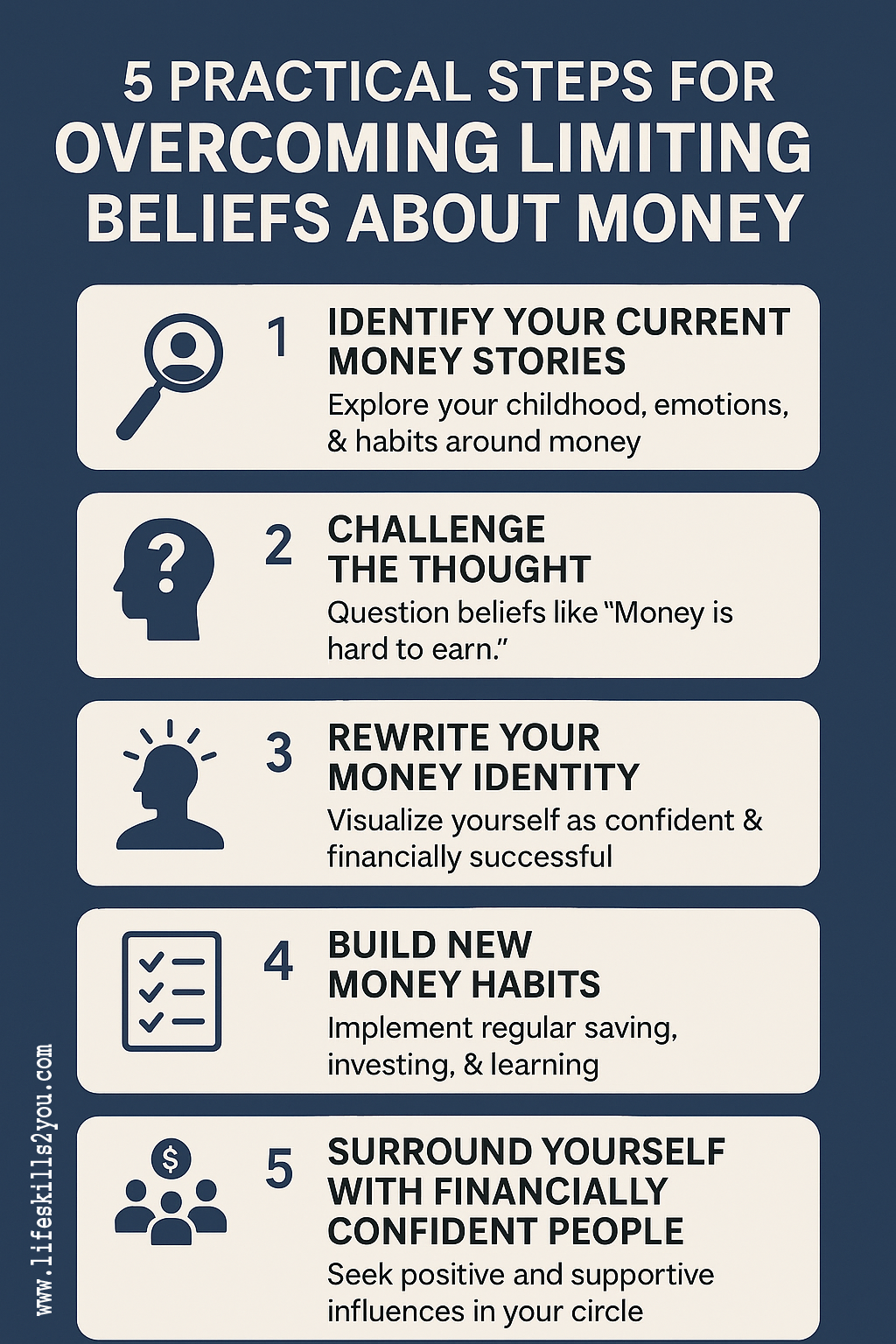

In this blog, we will walk through 5 Practical Steps for Overcoming Limiting Beliefs About Money, backed by:

✔ Behavioural psychology

✔ Cognitive reframing

✔ Coaching experience

✔ Real transformation stories

✔ Practical, repeatable exercises

This is not just another motivational blog — it is a mindset reset blueprint designed to help you understand your financial fears, break free from inherited patterns, and start building a healthier, empowered, and abundant relationship with money.

Let’s begin.

🟣 Understanding Money Beliefs: Why Your Mind Resists Wealth

Money beliefs are not logical. They are emotional, subconscious, and deeply rooted in your early experiences. To begin overcoming limiting beliefs about money, you must first understand where these beliefs come from — and how they silently control your financial choices.

🔵 How Money Beliefs Are Formed (Psychology Perspective)

According to behavioural finance research from Harvard Business School, financial decisions are influenced more by emotion and narrative than by income or knowledge. This means your money mindset is shaped by:

- Childhood environment

- Parental behaviour around money

- Cultural conditioning

- Religious messaging about wealth

- Economic trauma or past failures

- Social comparison and fear of judgment

Here are examples of how early experiences shape adult financial behaviour:

💡 Real-Life Example 1 — The “Money Causes Fights” Belief

A corporate leader I coached avoided high-paying roles for years. Why? He grew up seeing his parents fight every time money was discussed. Subconsciously, he believed:

“More money means more conflict.”

After we addressed the belief, he finally applied for — and secured — a senior position with a 48% salary increase.

💡 Real-Life Example 2 — The “I Don’t Deserve Wealth” Belief

A young woman from a modest family felt guilty charging fair prices in her freelance business. Her belief was:

“Good people shouldn’t want too much.”

Once we reframed the belief, her monthly income jumped from ₹20,000 to ₹75,000 in six months.

These stories prove one simple truth:

👉 You cannot change your financial life until you change the beliefs guiding it.

🟣 Step 1 — Identify Your Current Money Stories (Awareness Phase)

Awareness is the starting point for [5 Practical Steps for Overcoming Limiting Beliefs About Money]. Before rewriting your beliefs, you must surface them clearly.

🔵 The “Money Story Excavation” Exercise

Take out a notebook and answer these questions honestly:

- What did I hear about money as a child?

- How did my parents behave with money?

- What financial situations scared me growing up?

- What emotions do I feel when I think about earning, saving, investing, or spending?

- What money habits do I repeat even though they harm me?

💡 Real-Life Example 3 — The Overspender

One of my workshop participants realised she overspent not because she lacked control, but because spending made her temporarily feel “worthy.” That insight alone changed her entire relationship with money.

💬 Motivational Quote:

“Money doesn’t change you. It reveals who you believe you are.”

🟣 Step 2 — Challenge the Thought: “Is This Belief Actually True?” (Cognitive Restructuring)

Once you identify your money stories, the next step in [5 Practical Steps for Overcoming Limiting Beliefs About Money] is to challenge them with logic, psychology, and evidence.

This step is rooted in Cognitive Behavioral Therapy (CBT) — a proven psychological framework used worldwide, including at institutions like Harvard Health and the American Psychological Association.

CBT teaches that thoughts are not facts. They are interpretations.

When a limiting belief shows up, ask yourself:

“What evidence supports this belief — and what evidence disproves it?”

🔵 The Reframing Technique

Here’s a simple, effective process:

| Limiting Money Belief | Where It Came From | Why It’s Not True | Empowering Replacement Belief |

|---|---|---|---|

| “Money is hard to earn.” | Parents struggled financially | Millions earn more by learning skills | “Money grows with skills and strategy.” |

| “Rich people are greedy.” | Society & media portrayals | Many wealthy people donate, create jobs | “Money amplifies goodness.” |

| “I’m not good with money.” | Past mistakes | Skills can be learned anytime | “I’m improving my financial literacy daily.” |

This reframing is not about blind positivity.

It is about correcting distorted thinking that blocks growth.

💡 Real-Life Example — The Business Owner Afraid of Raising Prices

A client who ran a digital agency kept charging low rates because he believed:

“If I raise my prices, clients will leave.”

We challenged this belief using evidence:

- He had 6 years of experience

- His clients rated him 4.9/5

- Several competitors charged double for lower quality

Reality: His belief was fear-based, not fact-based.

After reframing, he increased his prices by 30% — and not a single client left.

His revenue rose significantly within 90 days.

🔵The “Belief Testing” Questions

Use these to break any financial block:

- Who taught me this belief?

- Is that person financially successful today?

- What would a financially confident version of me believe?

- What evidence exists against this belief?

- If a friend had this belief, what advice would I give them?

These small mental shifts create enormous behavioural change.

🟣 Step 3 — Rewrite Your Money Identity (Neuroscience + Behaviour Change)

Your identity — how you see yourself — determines your financial ceiling.

Neuroscience research from institutions like Stanford proves that identity-driven behaviour lasts longer than motivation-driven behaviour.

To continue the journey of overcoming limiting beliefs about money, you must consciously create a new version of yourself who handles money with confidence.

🔵What Is a Money Identity?

It is the internal image you hold about:

- How much you believe you can earn

- What level of financial comfort you feel “safe” with

- What kind of life you think you deserve

- How capable you believe you are with money

For example:

- If you see yourself as “average,” you will avoid high-paying opportunities.

- If you see yourself as “bad with money,” you will avoid investing.

- If you see wealth as “dangerous,” you will sabotage success.

🔵The Identity Upgrade Process

Use the “Future Self Mapping” method:

- Close your eyes

- Imagine the financially empowered version of yourself

- Notice:

- How they speak

- How they manage money

- How they make decisions

- How they negotiate

- Their confidence, posture, tone

- Now write:

- What they believe

- What habits they follow

- What boundaries they keep

This future-self identity becomes your internal GPS.

💬 Motivational Slogan:

“You don’t earn from your potential — you earn from your identity.”

💡 Real-Life Example — The Woman Who Didn’t See Herself as “Wealthy”

A participant in my financial psychology workshop proudly told me:

“I’m just a simple person… wealth isn’t for people like us.”

This belief kept her stuck at the same salary for 7 years.

We worked on rewriting her money identity.

Within months:

- She negotiated a raise

- Began her first SIP

- Built her emergency fund

- Started taking financial decisions confidently

Her external life changed only after her internal identity shifted.

🟣 Step 4 — Build New Money Habits (Behavioural Science Approach)

Once beliefs and identity shift, the next phase is execution.

Habits are the bridge between intention and transformation.

Behavioural scientists at Duke University estimate that 45% of daily behaviour is habitual, not conscious.

That means your financial future depends on the systems you build — not on willpower.

🔵The 6 Essential Money Habits for Growth

Include these to continue overcoming limiting beliefs about money:

- Weekly Money Review

- Track expenses

- Check investments

- Review goals

- Automated Saving System

- SIPs

- Recurring deposits

- Emergency fund autosave

- The 24-Hour Delay Rule

Helps reduce emotional, impulsive spending. - The Learning Habit (10 minutes/day)

Learn something new about:- investing

- financial psychology

- money management

- The Earning Growth Habit

Each month ask:

“What skill can I learn to increase my value?” - The Gratitude + Abundance Habit

Write 3 things you’re grateful for financially — rewires scarcity mindset.

🟣Step 5 — Surround Yourself With Financially Confident People (Environmental Psychology)

Your environment shapes your behaviour.

A study from the National Bureau of Economic Research found that people’s income levels correlate strongly with the economic behaviour of their peer groups.

If you want to succeed at overcoming limiting beliefs about money, upgrade your environment.

🔵Create a “Money Growth Circle”

Surround yourself with:

- Financially responsible peers

- Skilled mentors

- People who speak positively about money

- Investors and entrepreneurs

- Coaches or trainers

- Online communities that focus on growth

The conversations you hear shape the beliefs you adopt.

External Reference Example

Consider reading guides from Investopedia’s Beginner Financial Education section “financial education resources” to strengthen foundational knowledge in simple language.

Another useful resource is the Mindset articles on Psychology Today, which help understand mental blocks and behaviour patterns.

🟩 Conclusion

Money isn’t just a financial tool — it is an emotional story, a psychological pattern, and a behavioural habit. Most people try to improve their financial life by focusing only on income, but true transformation begins within.

By identifying, challenging, and rewriting your money stories, you start overcoming limiting beliefs about money from the root. When you pair this internal work with powerful habits, a new identity, and a supportive environment, your financial potential expands automatically.

You now have a complete roadmap:

✔ Awareness

✔ Cognitive reframing

✔ Identity shift

✔ Systems and habits

✔ Supportive circle

If you follow these steps consistently, you will not only change your financial mindset — you will change your entire life.

Final Call to Action

Thank you for exploring this insightful article.

If you’re hungry for more knowledge, don’t miss out on our other engaging articles waiting for you. Dive into our treasure trove of wisdom and discover new perspectives on related topics.

Click ‘Our Blog’ and ‘How to Guide’ to embark on your next adventure.

Happy reading!

🟦 10 FAQs 5 Practical Steps for Overcoming Limiting Beliefs About Money

1. What are limiting beliefs about money?

They are subconscious stories that shape how you feel and behave around money. These beliefs often come from childhood, past failures, or social conditioning.

2. How do limiting beliefs affect financial success?

They limit decisions, opportunities, risk-taking, and confidence. Your financial ceiling is determined by your psychological ceiling.

3. Can money beliefs really be changed?

Yes. With awareness, reframing, identity shifts, and new habits, beliefs can be replaced with empowering alternatives.

4. How long does it take to change your money mindset?

It varies. Some people see changes in weeks; others take months. Consistency is key.

5. What is the fastest way to improve financial confidence?

Start small: track money weekly, learn daily, and challenge negative thoughts regularly.

6. Are limiting beliefs always negative?

Not always, but many unconscious beliefs restrict growth and create self-sabotage.

7. How do I know if a belief is limiting me?

If a belief creates fear, excuses, or avoidance — it’s limiting you.

8. Can therapy or coaching help with money mindset?

Absolutely. CBT-based money coaching is one of the most effective ways to shift financial behaviour.

9. What if my environment reinforces negative money beliefs?

Join online communities, growth circles, or find mentors who can influence your mindset positively.

10. Do I need a high income to fix my money mindset?

No. Money mindset is independent of income. You can begin the transformation at any financial level.